Cash is king of digital payments

Wet market in Malmö. Crunchfish’s digital cash offers mobile wallets and payment rails the same simplicity, robustness and personal privacy as physical cash. Cash is the best means of payment. It always works, it’s easy to handle and it safeguards personal privacy. These features need to be preserved when cash goes digital. The transformation will […]

Wet market in Malmö. Crunchfish’s digital cash offers mobile wallets and payment rails the same simplicity, robustness and personal privacy as physical cash.

Cash is the best means of payment. It always works, it’s easy to handle and it safeguards personal privacy. These features need to be preserved when cash goes digital. The transformation will be rapid as digital cash will be present in all mobile wallets in the future.

Digital payments are available in many forms. Card payments compete with mobile wallets where money is transferred instantly between accounts. In parallel, central banks across the globe are investigating how their national currency will be digitized. What these payment methods have in common is that they are all dependent on a network connectivity to work.

– In order for transactions to work flexibly, securely and immediately, you have to drop the connectivity requirement and instead replicate the features of physical cash. To emulate physical cash, radical thinking and new technology is needed. Crunchfish has the solution for digital cash and offers it to mobile wallets as well as the payment rails, says Joachim Samuelsson, CEO of Crunchfish.

Integration directly with the payment rails

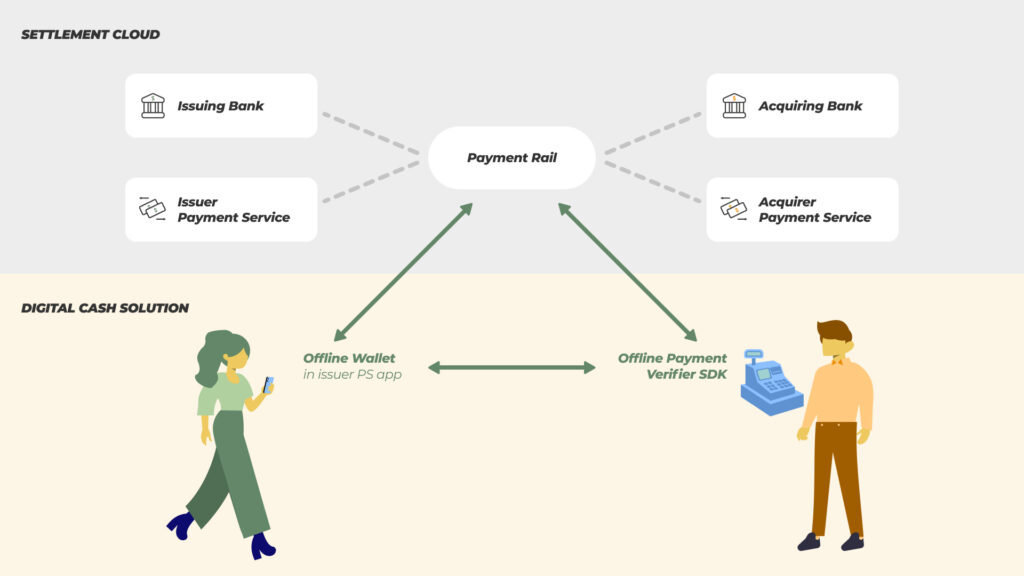

Crunchfish’s digital cash can be integrated with mobile wallets or directly with the digital payment rails. This creates enormous scalability since digital cash will be enabled in all mobile wallets using the payment rail. For the card infrastructure, Crunchfish’s digital cash brings another great advantage, as the merchant doesn’t need to have a card terminal to accept payments. Instead, the integration is done by Crunchfish’s offline payment solution. A similar integration is also possible for the central bank’s rails for digital currency, in order for it to be used offline or when any of the necessary cloud services are down.

– As for security, we use the same tried and tested technology as in tokenized card payments, where transactions are signed digitally from a secure element in the payment app. An offline balance is debited in the mobile and the payment is guaranteed even if the payee is offline. The payment is ear-marked for the payee and transferred via QR, NFC or BLE, to be verified by the payee either in a mobile, card terminal or directly in a cash register. The transactions – which are saved by both parties – are settled later when either party connects online, Joachim Samuelsson continues.

Integration with the payment rails for central bank digital currency (CBDC) and EMV card infrastructure. Crunchfish’s offline mobile payment solution for digital cash may be integrated with all payment rails.

Digital cash – a new standard for payments

Digital cash are always transferred immediately and swimmingly easy since they are independent of anything that can go wrong online.

– Crunchfish’s vision is that we will continue to pay with cash, but in a digital form. Only when you need access to more money than you have available in the mobile wallet do you need to connect online.

ABOUT CRUNCHFISH – crunchfish.com

Crunchfish develops globally scalable solutions for digital cash, eliminating all online risks from disruptions and downtime. Crunchfish is listed on Nasdaq First North Growth Market since 2016.