OFFLINE PAYMENTS

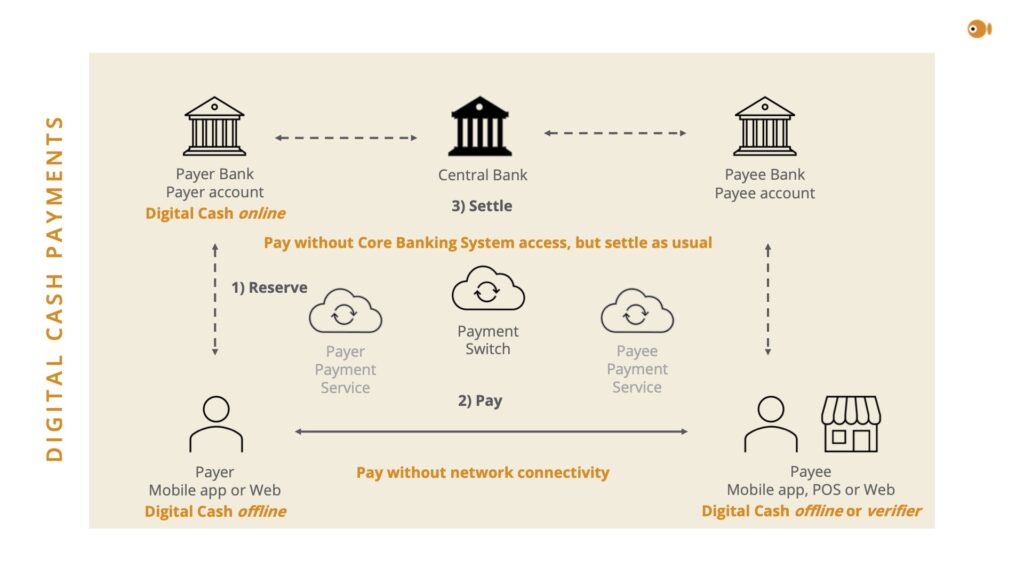

Crunchfish is a deep tech company offering a Digital Cash platform with offline payment capabilities for Banks, Payment Services, and CBDC implementations. Crunchfish makes payment services robust by providing survivability in the face of failure, whether it relates to lack of online connectivity or backend server outages.

Crunchfish has the bold ambition to take a global leadership position within payments.

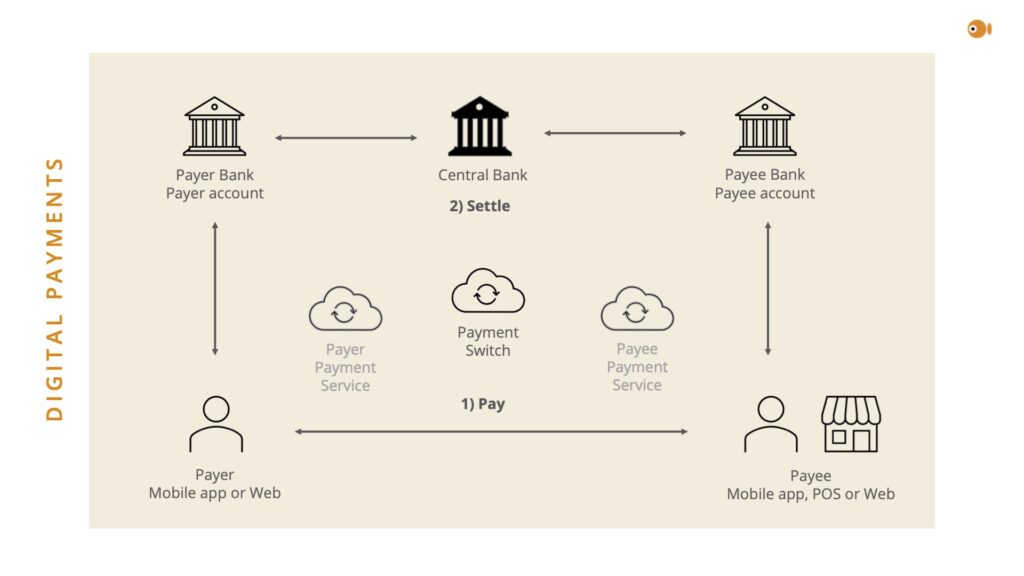

Why are we dependent

on the backend when we pay?

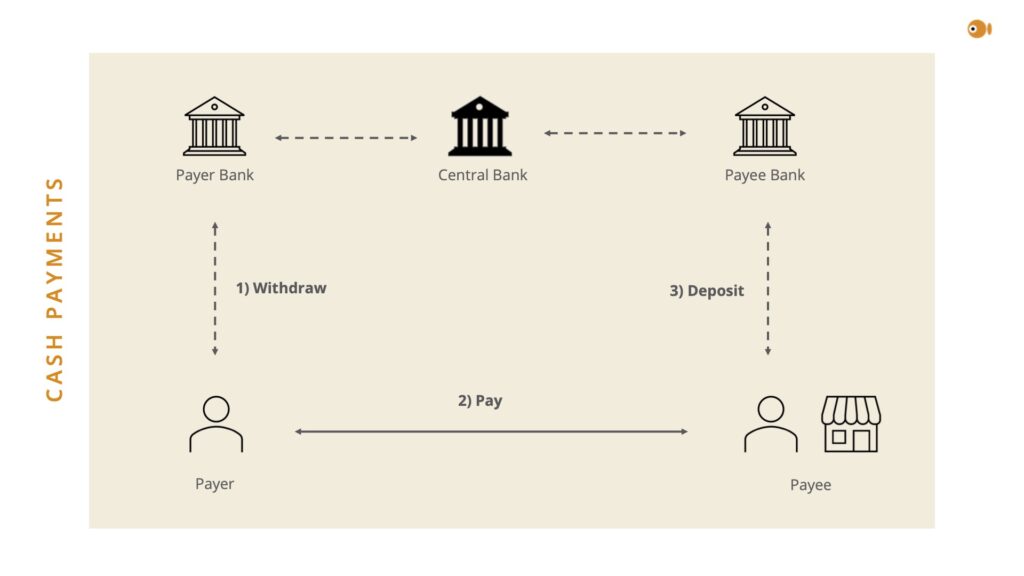

It is very convenient to pay with cash. It is easy to use and it safeguards personal privacy. The single most important property is that it always works. Crunchfish Digital Cash increases payment availability by allowing the Core Banking System to be offline during payment.

Crunchfish Digital Cash online enables that Digital goes Cash.

Why are we dependent

on the net when we pay?

It is very convenient to pay digitally. The pandemic drove digitization as many people do not want to touch cash anymore. But societies become vulnerable without cash, making us dependent on internet access and cloud based payments services.. This is an unnecessary risk to take.

Crunchfish Digital Cash offline enables that Cash goes Digital.

Crunchfish Digital Cash offline payment demos

Patents

Protected areas

Offline payments

Trusted Client Applications

Proximity interaction

Priorities from 2018.

16

UNIQUE INNOVATIONS

6

GRANTED INNOVATIONS*

*Includes positive International Preliminary Reports on Patentability (IPRP)

Contact us to learn more