Digital Cash implements CBDC swimmingly easy

Crunchfish is a technical pioneer within digital payments with its novel Digital Cash solutions that settle physical payments in two steps, first offline and then online, making digital payments robust and also preserves the payer’s integrity. Digital Cash is extremely flexible and interoperable with all types of payment services, even cross-border and cross-schemes. Today Crunchfish announces that its Digital Cash solutions can solve Central Bank Digital Currency, CBDC implementation issues swimmingly easy, without any additional infrastructure. This promises to have a major impact on the whole CBDC industry and accelerate Central Bank implementations.

Crunchfish’s Digital Cash makes it swimmingly easy to implement CBDC, as there is no need for additional infrastructure. Central Banks may just use existing digital payment rails to distribute CBDC. This is a tremendous simplification that will accelerate CBDC roll-outs in the world.

Central Banks in numerous countries are experimenting with Digital Currency using ‘tokenized value instruments’ that represent physical banknotes in digital form. Digital Cash by Crunchfish, on the other hand, use ‘tokenized transaction instruments’ instead, which may be compared to banker’s cheques. Whereas a banknote is a representation of ‘money’, a banker’s cheque represents a ‘money transfer’ between two parties.

Digitizing ‘money transfers’ instead of ‘money’ simplifies CBDC implementations tremendously, as it does not require any additional infrastructure. The ‘tokenized transaction instrument’ approach suggested by Crunchfish as Digital Cash provides all necessary properties of physical cash; robustness, ease of use and preserves the payer’s integrity in relation to banks. To issue its fiat currency, the Central Bank may simply deposit it into a centrally held bank account and invite commercial banks to access and distribute it by means of regular transactions on the existing digital payment rails.

Cash is king of digital payments. It always works, it’s easy to handle and it safeguards personal privacy. Crunchfish preserves these features when cash goes digital. The transformation will be profound as digital cash will be present in all mobile wallets in the future”.

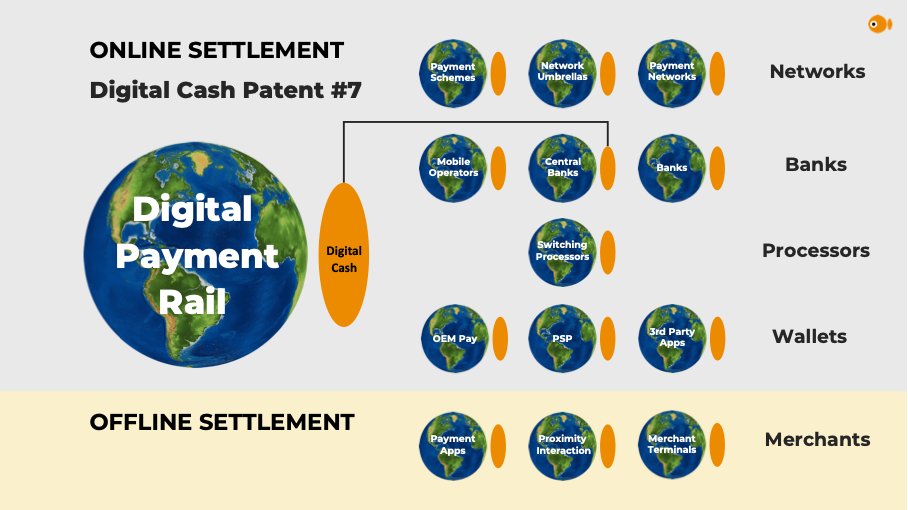

It is worth mentioning that Crunchfish’s flexible Digital Cash solutions with its patent-pending two-tier settlement architecture may be integrated with any payment scheme – Card, Real-Time Payments, Closed-Loop Wallets, Cryptocurrency as well as CBDC. It is therefore certainly still possible to be integrated with any of the current CBDC solutions based on ‘tokenized value instruments’, e.g. Digital Symmetric Cryptography from Crunchfish’s partner eCurrency or Distributed Ledger Technology blockchains.

About Digital Cash

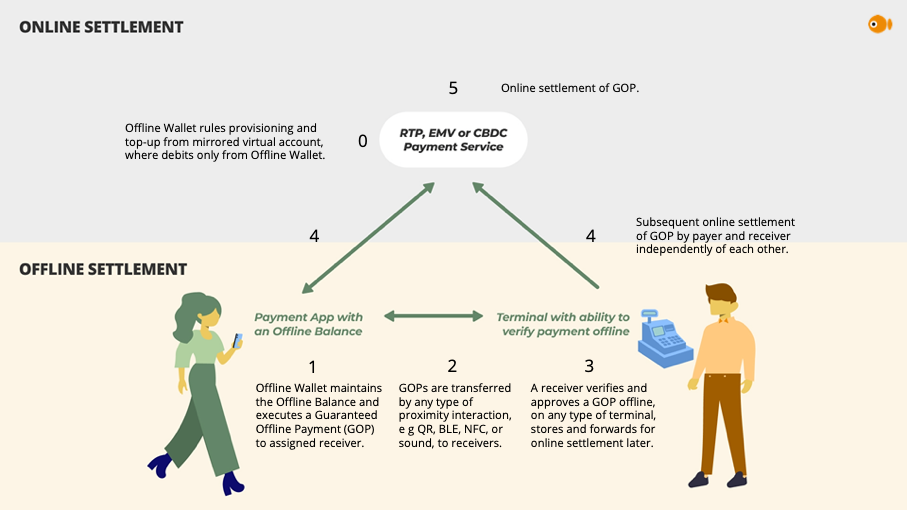

One year ago, Crunchfish announced offline frictionless mobile payments as a patent pending innovation, making mobile payments services far more robust by introducing the concept of Digital Cash using a two-tier settlement architecture, offline vs. online. The solution leverages the fact that it is not important to the merchants if the transfer to their accounts occurs at the moment-of-payment or a little later, as long as there is trust that the transfer will occur. It is critical however, that the payment experience must be robust, smooth and secure. This implies that the transaction cannot be dependent on the Internet and cloud payment services. No matter how much investments are made into IT-infrastructure, the systems will never be operational 24/7.

The ingenious solution for robust digital payments is based on an implementation of a two-tier settlement architecture. Recently, this approach was proposed by VISA in a research paper describing an Offline Payment System (OPS) protocol applied to CBDC. Crunchfish has also enrolled as a VISA Technology Partner.

Crunchfish’s flexible Digital Cash solutions with its patent-pending two-tier settlement architecture may be integrated with any payment scheme – Card, Real-Time Payments, Closed-Loop Wallets, Crypto as well as CBDC.

Crunchfish’s Digital Cash approach is ubiquitous as it may be integrated into any payment scheme and also on cards. In addition, Digital Cash is also payment services interoperable, cross-borders and cross-schemes, which is key to accelerate CBDC roll-outs and its market acceptance.

For more information, please contact:

Joachim Samuelsson, CEO of Crunchfish AB

+46 708 46 47 88

joachim.samuelsson@crunchfish.com

Ulf Rogius Svensson, IR & Marketing Manager

+46 733 26 81 05

ulf.rogius.svensson@crunchfish.com

Västra Hamnen Corporate Finance AB is the Certified Adviser. Email: ca@vhcorp.se. Telephone +46 40 200 250.

This information is information that Crunchfish AB is obliged to publish in accordance to the EU Market Abuse Regulation. The information was provided by the contact person above for publication on March 2, 2021.

About Crunchfish – crunchfish.com/digitalcash

Crunchfish is a tech company with a patent-pending solution for digital offline payments that can be integrated both with the payment rail or in a mobile wallet. The offline solution is globally scalable and makes digital payments more robust as the risks of disruptions and downtime are eliminated. We have also developed Blippit, an app terminal that connects to a cash register system for both online and offline payments. Crunchfish also develops gesture control of smart AR glasses for the consumer market. Crunchfish has been listed on Nasdaq First North Growth Market since 2016 with headquarters in Malmö, Sweden and with representation in India.