Cash is dead, long live cash!

Sweden might be cashless in three years’ time. That would mean the disappearance of the only means of payment that always works and never jeopardizes personal integrity. Although offering the unique features of cash in digital form is urgent, the process of finding an alternative is currently too slow. Besides, the technology used is inefficient and unnecessary. Now, Crunchfish is taking on a leadership role and showing how it’s done.

Even today, many businesses are opting out of cash. The digital cash equivalent will be welcome in commerce, since it’s far more secure, efficient and cheaper than how we currently handle cash.

The move towards a cashless society must have its benefits, but in the near future Sweden will be missing the only means of payment that always works. Downtime and long Internet disruptions could paralyze the country. The National Bank’s e-crown experiment has been debated in three webinars moderated by Crunchfish. Sadly, the process is a slow one, involving unnecessary blockchain technology that does not even address the core problem. For Sweden this is serious, as we’re poised to become the world’s first cashless society.

But the National Bank is not alone in being on the wrong track. The entire world’s Central Bank Digital Currency (CBDC) industry is at a dead end in its quest to digitize cash as a new money format, rather than offering the properties of cash digitally. It is not the banknote that should be digitized, but the money order. Both represent a value, but the money order also defines the payer and the payee. This simple yet fundamental change makes everything fall into place, and the old standard account-based way works just fine. The only thing required to offer the features of cash digitally is Crunchfish’s Digital Cash.

Crunchfish recently made a submission, in collaboration with Swish to the Swedish Post and Telecoms Agency’s innovation competition, implementing the unique features of cash to account based transactions. If Swish’s member banks choose to implement Digital Cash, Sweden will be offered digital cash guaranteed by the banking system, instead of the National Bank.

Two minute interview with Crunchfish CEO Joachim Samuelsson: Why Digital Cash?

Long interview with Crunchfish CEO Joachim Samuelsson on Digital Cash

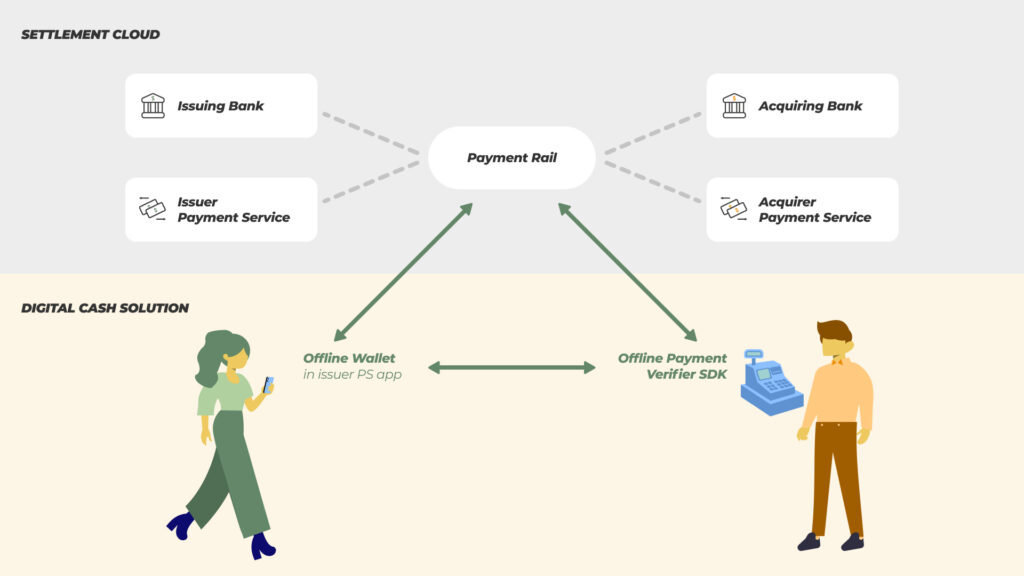

Crunchfish’s Digital Cash offers a digital wallet to all the world’s payment services, whether on mobile or on a cash card, usable even without an Internet connection. The digital wallet manages a balance that is linked to a virtual account where all transactions are registered when the user is online. The virtual account balance is blocked to guarantee coverage when offline payments are settled online against this account.

Crunchfish Digital Cash works with all payment schemes and is based on a patent-pending two-step settlement, first offline at the moment of payment, and then online when the cash is moved between the accounts. VISA recently proposed this architecture, as CBDC and Crunchfish are VISA’s technology partners. The most exciting part of this two-step architecture is its ability to offer globally interoperable payment services. Even in the future, cash is king.

About Crunchfish – crunchfish.com/digitalcash

Crunchfish is a tech company with a patent-pending solution for digital offline payments that can be integrated both with the payment rail or in a mobile wallet. The offline solution is globally scalable and makes digital payments more robust as the risks of disruptions and downtime are eliminated. Crunchfish has been listed on Nasdaq First North Growth Market since 2016 with headquarters in Malmö, Sweden and with representation in India.